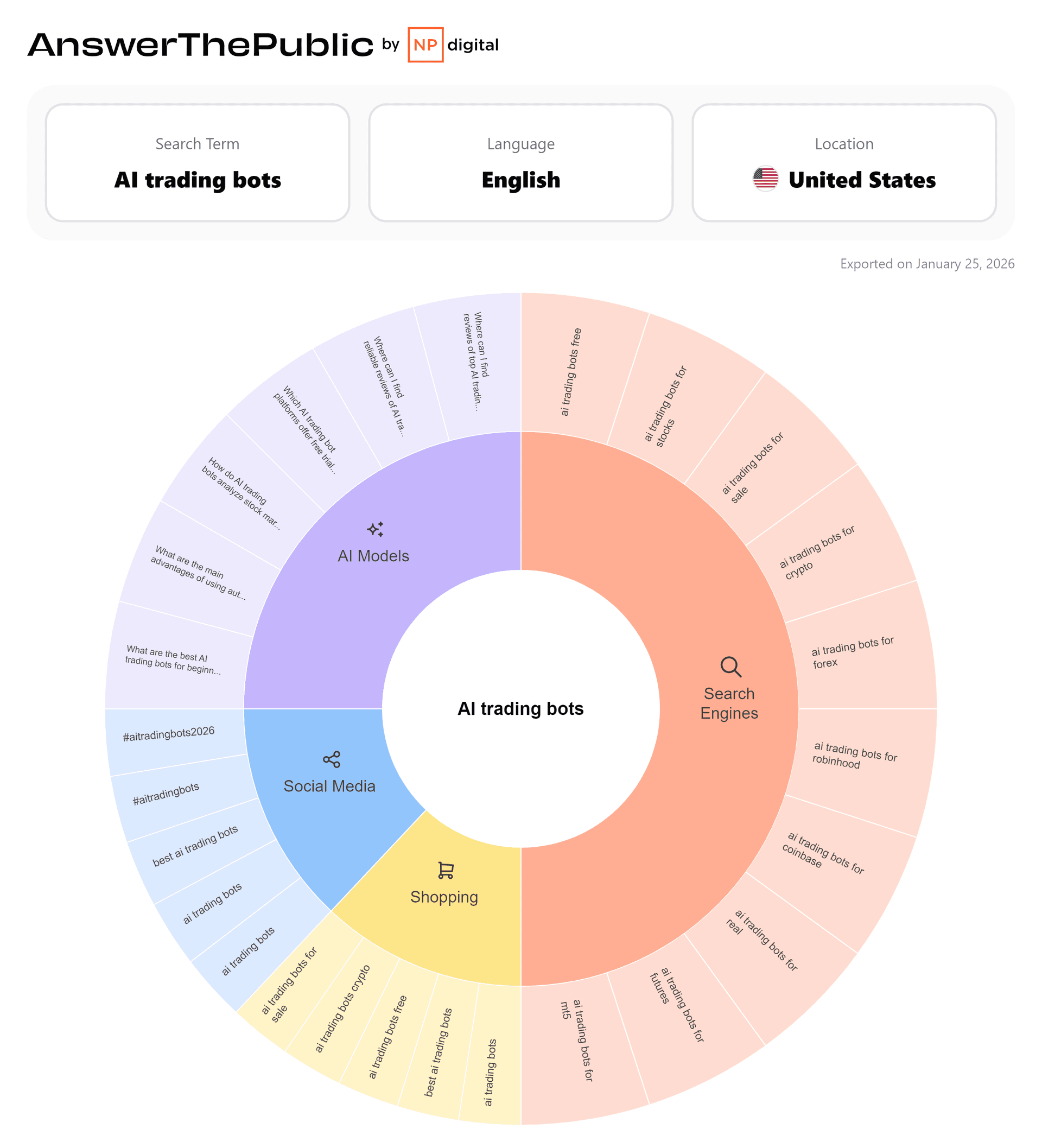

Data visualization wheel from "AnswerThePublic," exported on January 25, 2026, showcasing global search trends for the term "AI trading bots" in English within the United States.

The foreign exchange (FX) market, with a daily turnover exceeding $9.6 trillion in 2026, has undergone a fundamental transformation driven by the proliferation of autonomous trading architectures. As the algorithmic trading market grows from 25.04 billion in 2026, the distinction between institutional-grade execution and retail accessibility has narrowed. This report examines the technical mechanisms, search intent dynamics, and mathematical underpinnings of modern AI trading bots, specifically focusing on the low-competition, high-growth niche of "ai trading bot forex" as identified through current market analytics.

The evolution of these systems is best understood through the lens of specific architectural paradigms, ranging from multi-pair machine learning systems to specialized deep learning models for precious metals. This transition is documented extensively in the foundational work regarding the quantitative evolution and autonomous architectures of 2026, which highlights the shift from reactive algorithms to predictive, agent-based intelligence.

Market Demand and Search Intent Analysis

The current state of the "ai trading bot forex" keyword ecosystem reveals a significant opportunity for market penetration. Analysis of keyword variations indicates a total volume of 970 across 44 variations, with "ai forex trading bot" and "forex ai trading bot" leading the demand. Despite this interest, the Keyword Difficulty (KD%) remains manageable at approximately 30-32% for primary terms, categorized as "Possible" for ranking with well-structured, unique content.

The search intent for these terms is primarily informational, as evidenced by the high cost-per-click (CPC) of $3.78, indicating a valuable audience seeking education and reliable tools. Understanding the specific needs of this audience requires analyzing the questions users are asking about AI trading bots.

Table 1: Analysis of Search Intent Categories for AI Trading Bots

Intent Category | Primary User Inquiries | Strategic Implication for Developers |

|---|---|---|

Model Selection | What are the best AI trading bots for beginners? Which platforms offer free trials? | Emphasis on user-friendly interfaces (UX) and tiered access models. |

Technical Mechanics | How do AI trading bots analyze stock/forex markets? Do they actually work? | Need for transparent performance data and mathematical proofs. |

Review & Trust | Where can I find reliable reviews? Are there free versions available? | Integration of social proof and verifiable track records. |

Market Specificity | AI trading bots for Robinhood, Coinbase, MT5, and Futures. | Development of cross-platform API integrations. |

Operational Detail | AI trading bots for sale vs. subscription models. | Flexibility in monetization (SaaS vs. licensed software). |

Addressing these inquiries requires a deep dive into the underlying technology, explaining not just what these bots do, but how they perform multi-dimensional market synthesis. This level of detail is a prerequisite for users who are learning how to choose an AI trading bot that actually works, as they move beyond surface-level marketing toward quantitative verification.

The Architecture of Multi-Pair Machine Learning Systems

The modern FX environment is highly interconnected, where a move in one currency pair often signals a cascading effect across others due to cross-currency correlations and global liquidity flows. Single-pair models are increasingly viewed as insufficient because they ignore the systemic risk and opportunity present in the broader market structure.

The Archon system represents a pivotal advancement in this regard, utilizing a multi-pair machine learning architecture designed to identify systemic interactions before they manifest in price action. By treating the FX market as a dynamically evolving graph where nodes are currency pairs and edges represent correlation or sentiment co-movement, Archon can detect regime shifts that traditional models miss. The technical intricacies of this approach are detailed in the exploration of the architecture of a multi-pair machine learning trading system, which emphasizes the importance of understanding market topology.

Gated Residual Networks (GRN) and Variable Selection

A fundamental challenge in multi-pair modeling is "feature fatigue," where the sheer volume of data leads to noise amplification. The Archon architecture mitigates this using Gated Residual Networks (GRN) and Variable Selection Networks (VSN), components pioneered in the Temporal Fusion Transformer (TFT) framework.

The GRN allows the system to control information flow by selectively skipping unnecessary layers, ensuring that only the most predictive signals reach the final decision layer. This is mathematically achieved through the use of a Gated Linear Unit (GLU):

In this equation, is the input, is the context, is the Exponential Linear Unit, and provides the gating mechanism. The system's ability to switch between linear and non-linear processing is why tree-based models and Archon are winning the forex AI race; they adapt to the market's changing complexity in real-time.

Specialized Deep Learning for Gold and Commodities

While multi-pair systems handle broad market moves, certain assets like Gold (XAU/USD) require a specialized approach due to their unique volatility profiles and safe-haven status. The Aurum system was developed specifically to address these challenges, employing deep learning models trained on historical gold cycles and macroeconomic indicators.

Unlike retail traders who often succumb to fear and greed, Aurum utilizes emotional neutrality to execute predefined risk rules during sharp rallies or flash crashes. This systematic approach is built on a foundation of deep learning for gold, utilizing models that can handle the fat-tailed distributions and volatility clustering inherent in precious metals.

Table 2: Comparison of Leading Reputable AI Trading Platforms (2026)

Platform | Asset Focus | Core Mechanism | Distinctive Feature |

|---|---|---|---|

Tickeron | Forex, Stocks, Crypto | Financial Learning Models (FLMs) | |

Trade Ideas | Stocks, ETFs, Futures | "Holly" AI & Money Machine | |

ArchonV3 | Forex | Gradient boosting | Multi-Timeframe, Multifeature extraction |

AlgosOne | Forex, Crypto, Stocks | Institutional-grade ML | |

Jenova | Multi-asset Agents | GPT-5.2, Claude 4.5, Grok 4.1 | Multi-model agentic reasoning for macro |

Kavout | Equities, Crypto | "Kai" AI Quant Score | |

ChainGPT | Crypto, Blockchain | Deep Learning | |

WunderTrading | Crypto | TradingView Integration |

Advanced Temporal Modeling in FX

The success of an AI trading bot in 2026 depends heavily on its temporal modeling capabilities—its ability to understand not just what happened, but the sequence and duration of events. Traditional Recurrent Neural Networks (RNNs) like LSTMs and GRUs have long been used for this purpose, but they face limitations in capturing very long-range dependencies due to the vanishing gradient problem.

The industry has largely transitioned toward Transformer architectures, and specifically advanced temporal modeling, to overcome these hurdles. The Temporal Fusion Transformer (TFT) stands out because it combines the local processing of LSTMs with the global attention mechanisms of Transformers.

The Attention Mechanism and Interpretability

One of the most frequent questions users ask is "How do AI trading bots analyze the market?" The answer lies in the Multi-Head Attention mechanism, which allows the model to assign different weights to different historical time steps.

Mathematically, the attention function is defined as:

Where (Query), (Key), and (Value) are representations of the input data. By analyzing the attention weights, developers can see which specific news events or price patterns the model is "attending" to when it makes a buy or sell decision, providing a level of interpretability previously impossible in black-box systems. This breakthrough is a central theme in how deep learning is redefining AI forex trading.

Mathematical Foundations of Risk and Return

For the professional peer, the depth of an AI bot is measured by its loss function and its ability to optimize for risk-adjusted returns. Standard models often optimize for Mean Squared Error (MSE), but in FX, accuracy is secondary to risk-adjusted performance.

Quantile Loss and Probabilistic Forecasting

Modern bots like Archon and Tickeron often move beyond point predictions toward quantile regression. Instead of predicting a single price, the model predicts a range, allowing for a probabilistic assessment of risk.

The total loss for a quantile is:

This ensures that the bot is not just predicting the "most likely" outcome but is also aware of the "worst-case" scenarios in the 10th and 90th percentiles.

Table 3: Risk-Adjusted Performance Metric Formulas

Metric | Formula | Focused Utility |

|---|---|---|

Sharpe Ratio | Measures total risk-adjusted return (upside + downside) | |

Sortino Ratio | Penalizes only downside volatility (harmful risk) | |

Calmar Ratio | ||

Information Ratio | Measures consistency of outperformance against a benchmark |

Advanced bots are now integrating the Sharpe Ratio directly into their objective functions during training, a process known as adaptive Sharpe-based modeling. This forces the model to learn strategies that maximize return specifically relative to the volatility it creates, leading to more stable equity curves.

The Rise of Agentic AI and Multi-Model Architectures

As we look toward the future of forex and next-level trading intelligence, the narrative is shifting from "bots" to "agents". Platforms like Jenova and institutional systems like AlphaGPT by Man AHL demonstrate this shift.

An agentic system is not a single script but a group of specialized AI models working in concert:

The Idea Generator: Specialized in central bank policy interpretation and identifying "dovish/hawkish" language shifts in Fed or ECB statements.

The Implementer: Translates these macro ideas into Python code or execution strategies, interacting with proprietary databases.

The Evaluator: Rigorously tests the strategy against historical data, ensuring it passes statistical significance and risk-assessment thresholds.

This "digital research team" can process thousands of data points—from VIX volatility to 0DTE options flow—in seconds, a task that would take a human analyst days to synthesize.

Table 4: Multi-Model Agent Capabilities (Jenova Framework 2026)

Agent Profile | Core Models Used | Primary Function in FX |

|---|---|---|

Currency Intelligence | GPT-5.2, Grok 4.1 | |

Correlation Analyst | Gemini 3 Pro | Real-time cross-currency and equity market correlation matrices |

Options Strategist | Claude 4.5 | FX options Greeks analysis and volatility surface interpretation |

Technical Researcher | Specialized GNNs | Automated pattern recognition across multiple timeframes (1m to 1W) |

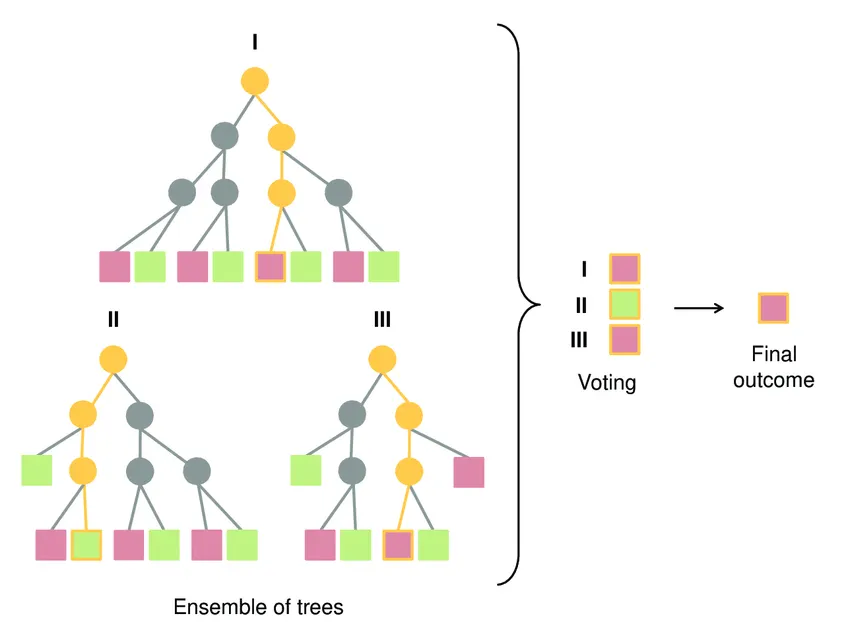

Operationalizing Tree-Based Ensembles

Despite the dominance of deep learning, XGBoost remains a preferred choice for many high-frequency FX applications due to its speed and performance on tabular data. The additive training process of XGBoost allows it to build a complex model by combining many "weak" decision trees into a single "strong" ensemble.

The Gain equation is the engine of this growth, determining how the model partitions the data to minimize the regularized objective:

Where and are the gradients, and are the Hessians, is the L2 regularization term, and is the minimum loss reduction required for a split. This mathematical rigor is why these models remain competitive, especially when integrated into the Archon framework.

Emerging Trends and 2026 Projections

As we conclude this analysis, it is essential to look forward to the AI and ML trends of 2026. The unease in the global economy—marked by fluctuating labor markets and housing instability—is being counterbalanced by a massive boom in AI capital expenditure.

Quantum Integration: The first prototypes of Quantum Temporal Fusion Transformers (QTFT) are being tested, promising exponential speedups in solving the high-dimensional dependencies of the FX market.

Autonomous Alpha Generation: We are moving toward a state where AI systems don't just execute trades but conduct the entire quantitative research process with minimal human intervention.

Real-Time Data Fusion: The ability to fuse technical, fundamental, and alternative data (like satellite imagery of shipping ports or real-time sentiment from encrypted channels) into a single execution signal is becoming the standard for elite bots.

The "ai trading bot forex" niche is no longer just about buying a script; it is about accessing an evolving ecosystem of agentic intelligence. By understanding the mathematical depth and architectural innovation of systems like Archon and Aurum, traders can navigate this liquid market with unprecedented precision and risk control. The quantitative evolution is here, and it is autonomous.

Works Cited

Forex Trading AI Agent: The Complete Guide to Intelligent Currency Market Analysis in 2026, accessed January 25, 2026, https://www.reddit.com/r/jenova_ai/comments/1qlgvvv/forex_trading_ai_agent_the_complete_guide_to/

AI FX Trading Bot: The Complete Guide to Intelligent Automated Currency Trading in 2026 : r/jenova_ai - Reddit, accessed January 25, 2026, https://www.reddit.com/r/jenova_ai/comments/1qlg9nn/ai_fx_trading_bot_the_complete_guide_to/

Systemic Risk Radar: A Multi-Layer Graph Framework for Early Market Crash Prediction, accessed January 25, 2026, https://arxiv.org/html/2512.17185v1

Inside Archon: The Architecture of a Multi-Pair Machine Learning Trading System, accessed January 1, 1970, https://www.auronautomations.app/blog/inside-archon-the-architecture-of-a-multi-pair-machine-learning-trading-system

MaGNet: A Mamba Dual-Hypergraph Network for Stock Prediction via Temporal-Causal and Global Relational Learning - arXiv, accessed January 25, 2026, https://arxiv.org/html/2511.00085v1

Multi-Sensor Temporal Fusion Transformer for Stock Performance Prediction: An Adaptive Sharpe Ratio Approach - MDPI, accessed January 25, 2026, https://www.mdpi.com/1424-8220/25/3/976

Quantum Temporal Fusion Transformer - arXiv, accessed January 25, 2026, https://arxiv.org/html/2508.04048v1

Interpretable Time Series Forecasting Using a Temporal Fusion Transformer - MATLAB & Simulink - MathWorks, accessed January 25, 2026, https://www.mathworks.com/help/deeplearning/ug/time-series-forecasting-using-temporal-fusion-transformer.html

Classification with Gated Residual and Variable Selection Networks - Keras, accessed January 25, 2026, https://keras.io/examples/structured_data/classification_with_grn_and_vsn/

Gated Residual Network block — layer_grn • aion - krzjoa, accessed January 25, 2026, https://krzjoa.github.io/aeon/reference/layer_grn.html

Temporal Fusion Transformers Model for Traffic Flow Prediction - EUDL, accessed January 25, 2026, https://eudl.eu/pdf/10.4108/eai.6-1-2023.2330350

Predicting Multi-Asset Returns with LSTM Networks: A Deep Learning Approach to Portfolio Allocation | by Steve Obasi | Dec, 2025 | Medium, accessed January 25, 2026, https://medium.com/@mapongo/predicting-multi-asset-returns-with-lstm-networks-a-deep-learning-approach-to-portfolio-allocation-ec8d6537b511

Building Aurum: A Deep Learning Trading System for Gold, accessed January 1, 1970, https://www.auronautomations.app/blog/building-aurum-a-deep-learning-trading-system-for-gold

How AI Trading and Fintech Innovation Are Redefining Digital Asset Management | MEXC News, accessed January 25, 2026, https://www.mexc.com/en-NG/news/287764

10 Best AI Trading Apps (January 2026) - Koinly, accessed January 25, 2026, https://koinly.io/blog/ai-trading-apps/

The 5 Best AI Stock Trading Bots in 2026 - WallStreetZen, accessed January 25, 2026, https://www.wallstreetzen.com/blog/best-ai-stock-trading-bot/

Momentum Stock Trading Powered by Tickeron AI, accessed January 25, 2026, https://tickeron.com/trading-investing-101/momentum-stock-trading-powered-by-tickeron-ai/

3 Best AI Trading Bots for 2026 - StockBrokers.com, accessed January 25, 2026, https://www.stockbrokers.com/guides/ai-stock-trading-bots

Best Trading Robots in the US - Investing.com, accessed January 25, 2026, https://www.investing.com/brokers/trading-robots/

Temporal Fusion Transformer (TFT): Implementation and optimization using Optuna | by Angel A. | Medium, accessed January 25, 2026, https://medium.com/@angelAjcabul/temporal-fusion-transformer-tft-implementation-and-optimization-using-optuna-d87c8aacfb3a

Long-term Stock Prediction Methods - Emergent Mind, accessed January 25, 2026, https://www.emergentmind.com/topics/long-term-stock-prediction-task

An Adaptive Sharpe Ratio-Based Temporal Fusion Transformer for Financial Forecasting, accessed January 25, 2026, https://www.researchgate.net/publication/389877674_An_Adaptive_Sharpe_Ratio-Based_Temporal_Fusion_Transformer_for_Financial_Forecasting

TFT - Nixtla - Nixtlaverse, accessed January 25, 2026, https://nixtlaverse.nixtla.io/neuralforecast/models.tft.html

Alternative Loss Function in Evaluation of Transformer Models - arXiv, accessed January 25, 2026, https://arxiv.org/html/2507.16548v2

What are the key considerations for implementing deep reinforcement learning in algorithmic trading systems? - Consensus, accessed January 25, 2026, https://consensus.app/search/what-are-the-key-considerations-for-implementing-d/0Bxw4HubT9WVJ1FT_MUVzg/

A Novel Loss Function for Deep Learning Based Daily Stock Trading System - arXiv, accessed January 25, 2026, https://arxiv.org/html/2502.17493v2

Production Forecasting Using Transfer Learning of Pretrained Deep Model - SUETRI-D, accessed January 25, 2026, https://suetrid.stanford.edu/research/production-forecasting-using-transfer-learning-pretrained-deep-model

Transformer Meets Time-Series - scieneers, accessed January 25, 2026, https://www.scieneers.de/wp-content/uploads/2023/10/tft_data2day_2023.pdf

Sortino ratio vs. Sharpe ratio - Meaning, Calculation & Comparison - Groww, accessed January 25, 2026, https://groww.in/p/sortino-ratio-vs-sharpe-ratio

Sharpe Ratio Explained: Formula, Calculation in Excel & Python, and Examples, accessed January 25, 2026, https://blog.quantinsti.com/sharpe-ratio-applications-algorithmic-trading/

Sharpe Ratio vs Sortino Ratio - QuestDB, accessed January 25, 2026, https://questdb.com/glossary/sharpe-ratio-vs-sortino-ratio/

Sortino: A 'Sharper' Ratio | By Thomas N. Rollinger & Scott T. Hoffman | Red Rock Capital - CME Group, accessed January 25, 2026, https://www.cmegroup.com/education/files/rr-sortino-a-sharper-ratio.pdf

Sharpe Ratio vs Sortino Ratio: Measuring Risk-Adjusted Returns - Stock Titan, accessed January 25, 2026, https://www.stocktitan.net/articles/sharpe-ratio-vs-sortino-ratio

What AI Can (and Can't Yet) Do for Alpha | Man Group, accessed January 25, 2026, https://www.man.com/insights/what-ai-can-do-for-alpha

A Trend Following Deep Dive: AI, Agents and Trend | Man Group, accessed January 25, 2026, https://www.man.com/insights/ai-agents-trend

Options Trading AI Agent: The Complete Guide to Intelligent Derivatives Strategy in 2026 : r/jenova_ai - Reddit, accessed January 25, 2026, https://www.reddit.com/r/jenova_ai/comments/1qhbvxp/options_trading_ai_agent_the_complete_guide_to/

AI Short-Term Options Trading Agent: The Complete Guide to Intelligent Intraday Derivatives Strategies in 2026 : r/jenova_ai - Reddit, accessed January 25, 2026, https://www.reddit.com/r/jenova_ai/comments/1qkm1vj/ai_shortterm_options_trading_agent_the_complete/

AI Stock Trend Analysis Agent: The Complete Guide to Intelligent Market Analysis in 2026 : r/jenova_ai - Reddit, accessed January 25, 2026, https://www.reddit.com/r/jenova_ai/comments/1qfc09h/ai_stock_trend_analysis_agent_the_complete_guide/

AI Stock Data Analysis Agent: The Complete Guide to Intelligent Data Processing in 2026 : r/jenova_ai - Reddit, accessed January 25, 2026, https://www.reddit.com/r/jenova_ai/comments/1qhusfc/ai_stock_data_analysis_agent_the_complete_guide/

XGBoost Parameters — xgboost 3.1.1 documentation, accessed January 25, 2026, https://xgboost.readthedocs.io/en/stable/parameter.html

The Notorious XGBoost - Towards Data Science, accessed January 25, 2026, https://towardsdatascience.com/the-notorious-xgboost-c7f7adc4c183/

The Math Behind XGBoost - Medium, accessed January 25, 2026, https://medium.com/@cristianleo120/the-math-behind-xgboost-3068c78aad9d

Creating a Technical Indicator Based Strategy: XGBoost | by David Borst | Medium, accessed January 25, 2026, https://datadave1.medium.com/creating-a-technical-indicator-based-strategy-xgboost-b6fd5a79e705

Investment Outlook for Public Markets in 2026 - Goldman Sachs Asset Management, accessed January 25, 2026, https://am.gs.com/en-no/advisors/insights/article/investment-outlook/public-markets-2026

Hedge Fund Strategy Outlook: Q1 2026: Too Hard to Price? - Man Group, accessed January 25, 2026, https://www.man.com/insights/Q1-2026-Hedge-Fund-Strategy-Outlook

Quantum Temporal Fusion Transformer - arXiv, accessed January 25, 2026, https://www.arxiv.org/pdf/2508.04048