Check out Archon, Auron AI and Aurum AI - our AI Trading Bots on MQL5 Marketplace

For most of modern trading history, success in the forex market depended on experience, screen time, and intuition. Traders learned to read charts, interpret news, and manage risk—often under pressure, fatigue, and emotion.

But the foreign exchange market has grown too large, too fast, and too complex for intuition alone. With more than $7.5 trillion traded daily, human reaction speed and manual analysis are no longer enough. This is where the intelligence shift begins.

As we move toward 2026, AI forex trading is not replacing traders—it is replacing inefficiency.

From Human Judgment to Machine Intelligence

The earliest algorithmic trading systems were rigid by design. They followed predefined rules, static indicators, and assumptions that markets behaved consistently over time. When volatility changed or regimes shifted, those systems failed—often catastrophically.

Modern markets do not repeat cleanly. They adapt, fragment, and mutate.

This realization gave rise to machine learning in forex trading—systems that do not merely execute rules, but continuously refine their understanding of the market. Instead of being told what a valid setup looks like, machine learning models analyze historical price behavior, volatility regimes, and outcomes to infer what actually works.

This transition—from static logic to adaptive intelligence—is what separates yesterday’s “Quant 1.0” strategies from today’s AI-driven trading systems.

How AI Understands the Forex Market

Forex prices are not random, but they are deeply nonlinear. Interest rates, liquidity flows, macroeconomic releases, sentiment, and geopolitics interact in ways that cannot be captured by a single indicator or formula.

To handle this complexity, modern AI trading algorithms for forex rely on specialized learning architectures—each built to model a different dimension of market behavior.

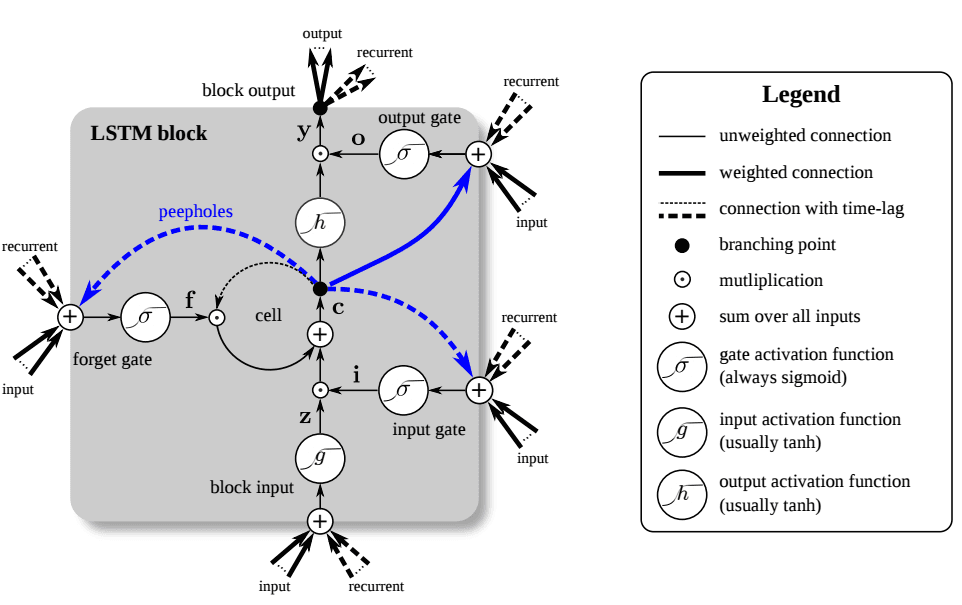

Memory and Context: LSTM Models

Figure 1: A Long Short-Term Memory (LSTM) unit. The LSTM unit has four input weights (from the data to the input and three gates) and four recurrent weights (from the output to the input and the three gates). Peepholes are extra connections between the memory cell and the gates, but they do not increase the performance by much and are often omitted for simplicity. Image by Klaus Greff and colleagues as published in LSTM: A Search Space Odyssey. Image by Klaus Greff and colleagues as published in LSTM: A Search Space Odyssey. Image source: NVIDIA

Currency markets are sequential by nature. What happens today is shaped by what happened yesterday, last week, and sometimes months ago. LSTM forex models are designed specifically to handle this temporal dependency.

Unlike traditional models that quickly “forget” older information, LSTMs maintain selective memory. They learn which historical patterns matter—such as sustained accumulation, exhaustion phases, or volatility compression—and which should be ignored. This allows them to recognize trends and cycles as they develop, rather than reacting too late.

In practice, LSTMs help AI systems distinguish between noise and meaningful continuation.

Perspective at Scale: Attention and Transformers

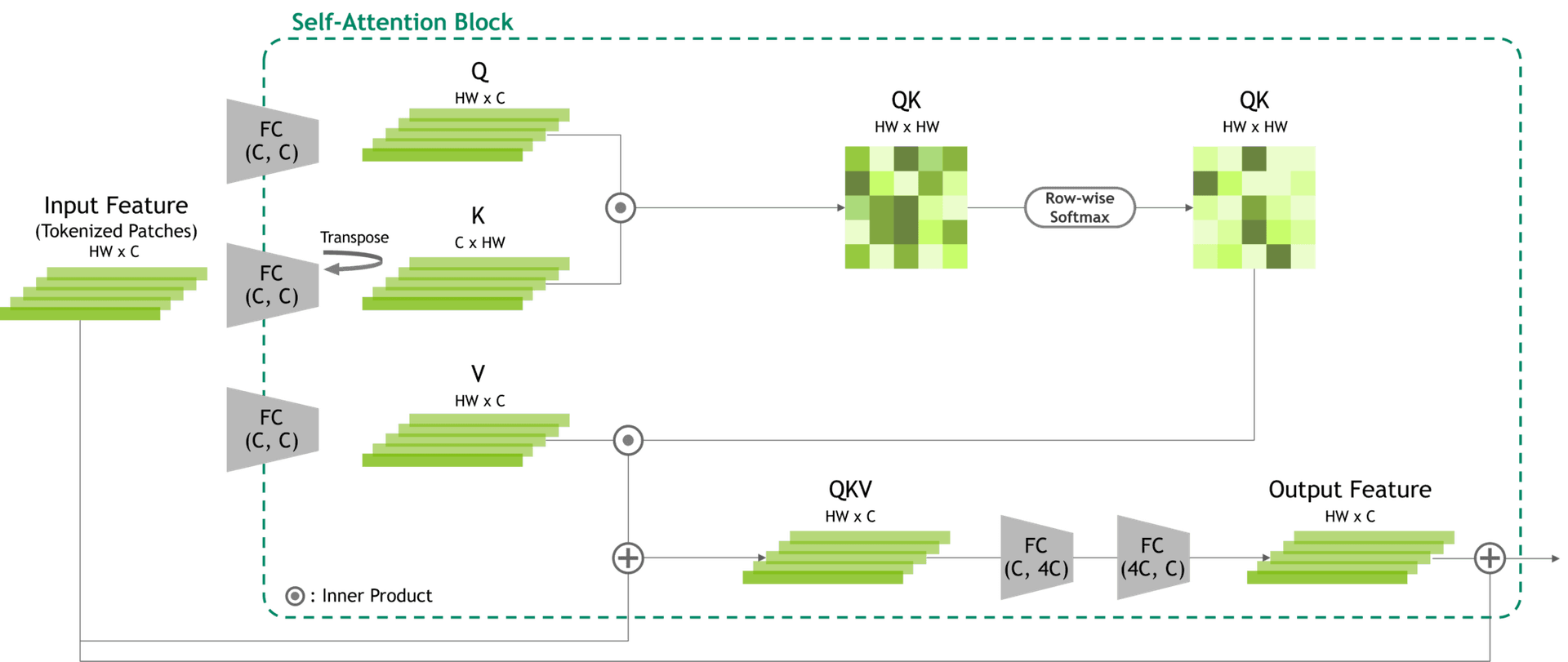

Figure 2: An illustration of self-attention in a typical transformer block for vision applications. Source: Nvidia

Some market events leave long shadows. A central bank decision, a liquidity shock, or a geopolitical conflict can influence price behavior far beyond the moment it occurs.

Transformer-based architectures address this by using attention mechanisms. Instead of processing data strictly step-by-step, they evaluate entire sequences at once, assigning importance to different historical moments. This allows AI systems to weigh distant but relevant events alongside recent price action.

The result is broader market awareness—an understanding of context, not just momentum.

Learning by Doing: Reinforcement Learning

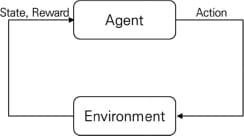

Figure 3: Basic architecture of reinforcement learning (RL): an agent, environment, state, action and reward.

While LSTMs and Transformers focus on understanding the market, reinforcement learning trading systems focus on behavior.

Rather than predicting the next price, reinforcement learning agents learn through interaction. They simulate thousands of trading scenarios, receiving feedback in the form of rewards and penalties. Over time, the system discovers which actions—entering, holding, scaling, or exiting—produce the best outcomes under different conditions.

This approach allows AI to refine execution logic dynamically, adapting position sizing, timing, and risk exposure as market conditions evolve.

The goal is not prediction perfection, but decision optimization.

The Moment AI Became Inevitable

For years, AI trading remained largely institutional. Development costs were high, infrastructure was expensive, and access was limited to hedge funds and proprietary desks.

That changed after 2023.

As AI development accelerated and training efficiency improved, search interest in terms like “AI forex trading” and “AI trading bots” surged worldwide. By late 2025, public interest reached historic highs—not because of hype, but because performance became visible.

Retail traders began to realize something critical: the same intelligence once reserved for institutions was now accessible.

When Automation Meets Discipline

The most visible outcome of this shift is the rise of AI trading bots. By 2025, automated systems were responsible for the majority of forex trading volume.

Their advantage is simple:

- •

They operate continuously across global trading sessions

- •

They execute without fear, hesitation, or emotional bias

- •

They enforce risk management rules consistently—even under stress

But automation alone is not intelligence. True AI systems adapt to change. Poor systems simply repeat mistakes faster.

Turning Advanced AI Into Practical Trading Systems

At Auron Automations, the objective is not to sell complexity—it is to deliver usable intelligence. Every system is engineered for live market conditions, where spreads widen, volatility spikes, and execution quality defines profitability.

Aurum AI — Precision in Volatile Gold Markets

Aurum AI was built for traders navigating the unique volatility of gold. It combines adaptive logic with disciplined execution, helping traders remain systematic in markets that punish emotion.

Archon V3 — Structured Automation for Forex

Archon V3 emphasizes clarity and control. It is designed for traders who value structure—filtering unfavorable conditions, reducing noise, and enforcing consistency across sessions.

Auron AI — Adaptive Intelligence Across Market Regimes

Auron AI represents the convergence of machine learning concepts and real-world trading constraints. It adapts behavior as conditions change, allowing traders to scale intelligently rather than emotionally.

The Risk Beneath the Revolution

Rapid adoption has a downside. As interest in AI trading grows, so does misinformation.

Unrealistic promises, opaque “black-box” bots, and exaggerated win rates flood the market. These systems fail not because AI doesn’t work—but because it is misapplied.

Real AI trading systems prioritize probability, drawdown control, and long-term survival. Anything promising certainty is already lying.

The Future Is Not AI vs Humans

Despite popular fear, AI is not replacing traders. It is redefining their role.

The future belongs to traders who think strategically and let machines execute tactically. Humans define intent, constraints, and risk tolerance. AI handles speed, scale, and adaptation.

This is the Man + Machine era—and it is already here.

Discover intelligent trading systems at Auron Automations and step into the next evolution of forex trading.